Welcome to The Refresh, your weekly download of what actually matters in advertising. Brought to you by Marketecture Media and written by AdTechGod.

Every Thursday, we bring you the latest news, commentary, and memes that speak the truth about this industry. If it's happening in AdTech, media, or marketing and it’s interesting, it’ll be here.

Want faster updates and sharper takes on what’s happening in advertising, media, and AdTech? Follow me on LinkedIn for the latest news, insights, and commentary as it happens.

Lego is building out an in-house programmatic team (Digiday)

Fubo Hits 6.2M Combined Subs After Closing Disney’s Hulu Merger (TVNewsCheck)

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’ (Digiday)

Axios, OpenAI expand partnership to scale local news (Axios)

Publicis Expands Working With Cancer Initiative With New Research and AI Coach (ADWEEK)

Jennifer Louie Oon, SVP of Sales at DAX US, on Audio’s Missing Middle and Monetization

Jennifer Louie Oon, Senior Vice President, Sales at DAX United States, shares her non-linear career path, why audio remains underfunded, and how premium ad-supported audio can unlock scale, measurement, and growth for brands and publishers.

Inside Sweet Suites: CES 2026

Sweet Suites at CES 2026 brought high-energy suite walkthroughs and candid conversations with leaders from Life360, Sojern, LG Ad Solutions, and Affinity Solutions, digging into the latest shifts in data, identity, CTV, commerce, travel, and consumer trust.

Amazon Is the New Heavyweight Champion of Sports Streaming

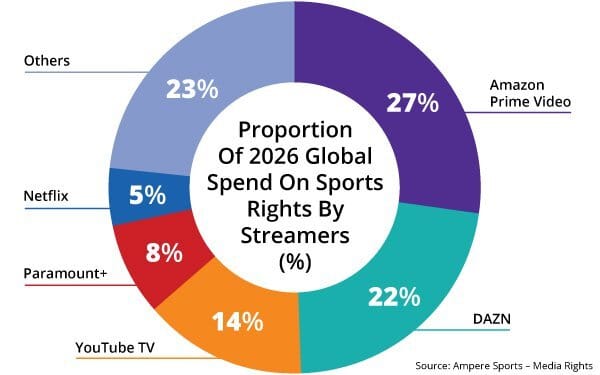

The sports world is seeing a massive shift this year, with streaming platforms dropping a cool $14.2 billion on broadcast rights. Amazon Prime Video has officially taken the lead, grabbing 27% of the market share. They've poured about $3.8 billion into their lineup for 2026, finally knocking DAZN off the top spot it held for so long.

Amazon really cemented this lead with that massive 11-year NBA deal, which costs it $1.8 billion every year. Between that, its long-term hold on NFL Thursday Night Football, and picking up UEFA Champions League rights in several European countries, the company is becoming hard to beat.

Meanwhile, DAZN still holds a solid 22% of the market. It’s active in about 200 countries, mostly focusing on soccer and combat sports like boxing and MMA. It even dropped $1 billion for the FIFA Men’s Club World Cup rights for 2025. There are also rumors it’s looking to buy up U.S. regional sports networks—the ones that used to be Bally Sports—which would give it local rights for MLB, NBA, and NHL teams.

Even with all that spending, DAZN has lost some ground, like when Paramount+ snatched away the Champions League rights in Germany. As for the rest of the field, YouTube TV is sitting at 14%, followed by Paramount+ at 8% and Netflix at 5%. It’s clear the streaming wars have moved from the cinema to the stadium.

Fox Trades Political Ad Dollars for Sports and Tubi Gains

Fox is proving there’s life after election season. Even without the massive political ad spend of 2024, the company grew its total revenue by leaning into Tubi’s growth and higher prices for news and sports. However, staying in the game isn't cheap; net income dipped to $247 million, largely because the cost of sports rights and production is climbing.

On the TV side, Tubi and extra MLB postseason games helped keep things steady, while the cable segment saw a 5% revenue jump. Despite the industry-wide trend of people cutting the cord, Fox managed to offset subscriber losses with contractual price hikes. CEO Lachlan Murdoch pointed to this as proof that the company’s strategy is working, even as it absorbs higher operating costs. To keep investors happy, the company also bought back $1.55 billion in stock and declared a new dividend.

The IAB Hits 30 and Declares War on "AI Free-Riders"

The IAB is turning 30 this year, and CEO David Cohen is making it clear that the organization hasn't forgotten its publisher roots. At its latest leadership meeting, Cohen pushed back against critics who say the group has drifted toward tech giants, arguing that without healthy publishers, the entire ad ecosystem has nothing to "optimize" or engage with.

The big headline is Cohen’s new "Accountability for Publishers Act." He didn’t mince words, calling AI companies that train models on publisher content without paying for it "free-riders" and flat-out accusing them of stealing. The IAB is already pitching this to senators to ensure creators get a piece of the AI pie.

Beyond the AI fight, Cohen is focusing on cleaning up the messy world of connected TV (CTV). He wants to move away from the "Wild West" of dozens of different ad sizes and formats, pushing for a handful of standards so the industry can actually scale. He also touched on the shift from targeting humans to "agents"—the AI assistants doing the browsing for us—and how measurement needs to evolve to keep up.

Marketecture Live III

Where the Industry Gets Honest About What’s Next

Join us March 10–11 at The Glasshouse in NYC for a limited-seat event built for leaders looking for what’s next in advertising.

Brand and marketing leaders looking to stay ahead of consumer shifts and growth channels in 2026 can apply for a complimentary pass.

Agency executives and strategy and media teams exploring what’s next in planning and creative effectiveness can apply for a complimentary pass.

Publishers and groups of (3) or more navigating AI disruption and retail media realities receive special rates.

Thanks for reading this week’s The Refresh by Marketecture.

Marketecture Media is committed to bringing you the latest news, opinions, and community updates.

If you are interested in advertising on this newsletter, our podcasts, The Advertising Forum, or in our Slack community, you can contact us here.